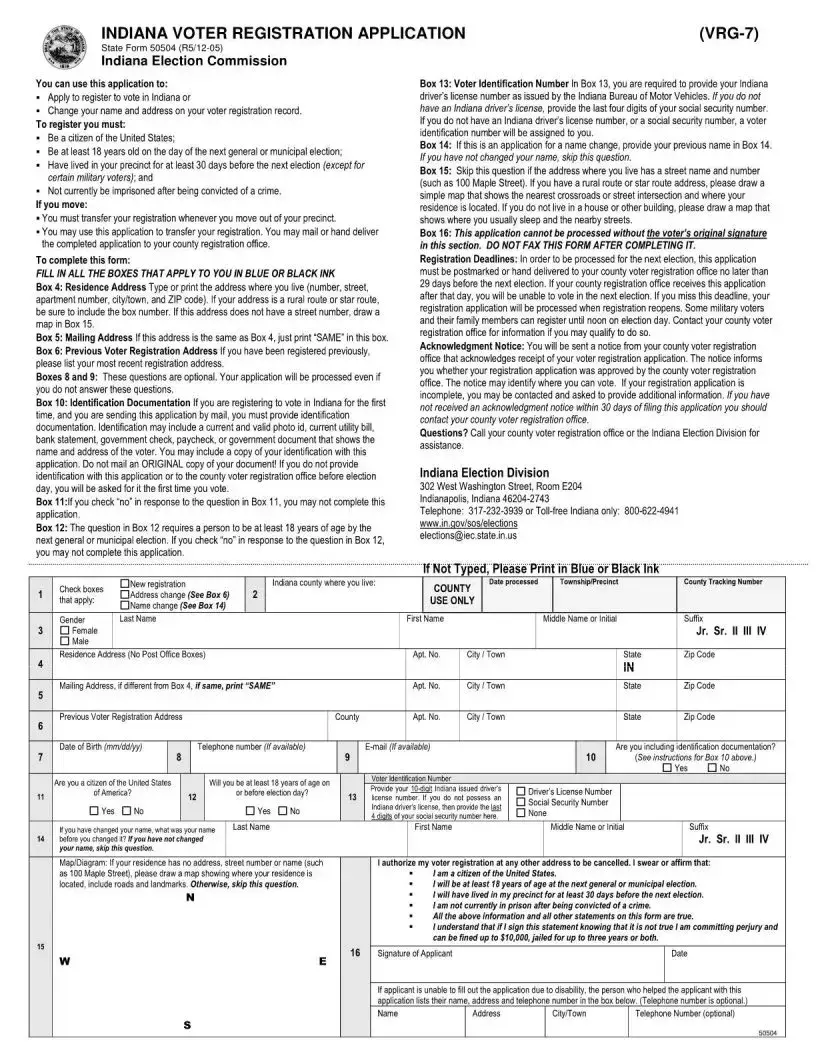

What is the Indiana State 50504 form?

The Indiana State 50504 form is a document used within the state of Indiana, designed to serve a specific function or requirement set by a state authority. The form's exact purpose involves gathering pertinent information in a standardized format, which may be related to various administrative, legal, or regulatory processes within the state. It's a cornerstone for ensuring that the information provided by individuals or entities meets state guidelines and is processed efficiently.

Who needs to fill out the Indiana State 50504 form?

Typically, the requirement to fill out the Indiana State 50504 form falls on residents or entities within Indiana that are engaging in particular activities or transactions that fall under state regulation necessitating this form. This could include applicants for certain state benefits, licensees in specific professions, or participants in state-administered programs. Identifying whether you need to complete this form usually involves consulting state regulations, guidance from state departments, or professional advisories.

How can someone obtain the Indiana State 50504 form?

Obtaining the Indiana State 50504 form is generally straightforward. The form can often be downloaded from the relevant department's website within the Indiana state government. Additionally, physical copies may be available at the offices of the department responsible for overseeing the form's intended use. For those with limited Internet access or who prefer hard copies, contacting the relevant state department directly via phone or a written request can provide another avenue to secure the form.

What information is required when filling out the Indiana State 50504 form?

The specific information required on the Indiana State 50504 form varies depending on its application but typically includes personal identification details, such as name and contact information, alongside specific information related to the form's purpose. This might involve detailed descriptions of activities, financial information, or other pertinent details that enable the state to process the form accurately. Accuracy and thoroughness in completing the form are crucial to ensure smooth processing and to avoid delays.

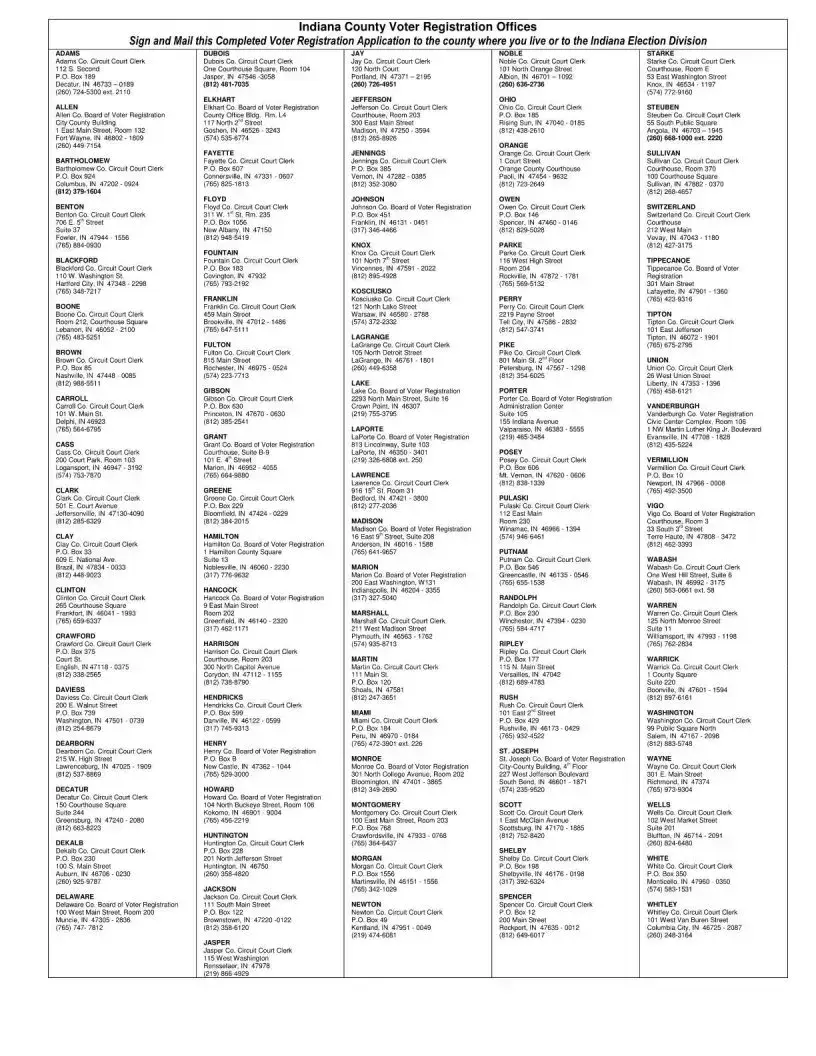

Where does one submit the completed Indiana State 50504 form?

Once completed, the submission process for the Indiana State 50504 form also depends on the nature of its use. In many cases, the form can be submitted online through the website of the relevant Indiana state department. Alternatively, it may be required to mail the form to a specific state office or deliver it in person. The exact submission instructions, including addresses and any additional requirements (such as accompanying documentation), are typically provided with the form or can be found on the corresponding department's website.