What is the purpose of the Indiana State 43931 form?

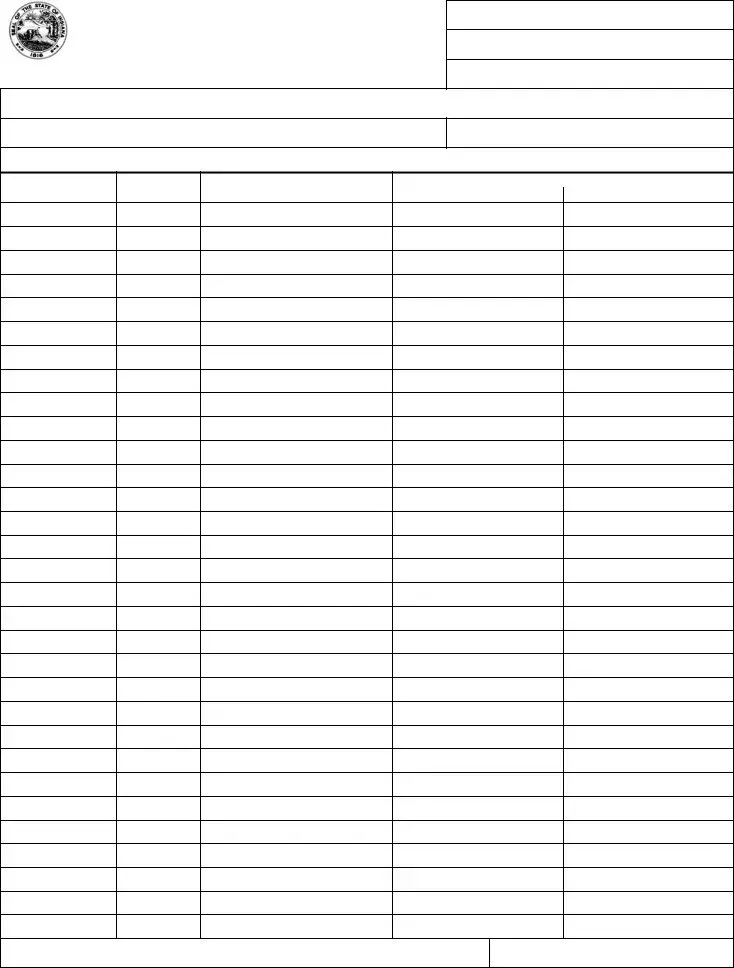

The Indiana State 43931 form is designed for the convenience of self-employed individuals who need to report their gross monthly income and their monthly business costs. This form provides a structured way to present the necessary financial details pertinent to income and expenses related to self-employment, ensuring accurate records are maintained for each month.

Who needs to complete the Indiana State 43931 form?

Any self-employed individual in Indiana who requires to report their monthly income and business expenses to a caseworker or similar authority must complete this form. It’s especially relevant for those seeking assistance or under programs where financial reporting is a criterion for eligibility or continued participation.

How is income recorded on the form?

Income should be recorded in the designated section by stating the amount of income received each day for the month being reported. This includes detailing the day, hours worked, and the total income for that day. It provides a clear, day-by-day breakdown of earnings for the entire month.

How are business costs reported on the form?

Business costs are reported in a similar manner to income, by listing each type of cost, the day it occurred, and the amount. This section allows for a detailed account of monthly business expenses, offering a clear view of the financial outputs associated with self-employment.

What is the significance of signing the Indiana State 43931 form?

Signing the form is a declaration by the self-employed individual that the information provided is accurate and truthful to the best of their knowledge. The signature, along with the date signed, is a necessary component to validate the document, making it legally significant for reporting purposes.

Can the form be used to report income for any month?

Yes, the form can be used to report income and business expenses for any month. Each reporting should correspond to a single month's financial activity, requiring separate forms for each month that needs to be reported.

What should be done if there are more expenses than the form allows?

In situations where business expenses exceed the space provided on the form, individuals should attach an additional sheet detailing the remaining expenses. It is important to ensure all relevant financial activity is reported, so attaching additional sheets is an acceptable and advisable practice.

Where does one submit the completed Indiana State 43931 form?

The completed form, including any additional sheets if necessary, should be submitted to the caseworker or the specific department indicated by them. The case name, case number, and name of the caseworker or identification number should be clearly indicated on the form to ensure it is directed appropriately.