INSTRUCTIONS

General Instructions:

1.Please enter information into all of the areas of the First Report form, except the boxes at the top right corner of the form which is for office use only.

2.Enter all dates in MM/DD/YY format.

3.Please return completed form electronically by an approved EDI process.

4.For answers to questions, please call (317) 232-3808.

Definitions:

AGENT NAME AND CODE NUMBER: Enter the name of your insurance agent and his / her code number if known. This information can be found on your insurance policy.

ALL EQUIPMENT, MATERIALS OR CHEMICALS EMPLOYEE WAS USING WHEN ACCIDENT OR EXPOSURE OCCURRED: List anything the employee was using, applying, handling or operating when the injury or exposure occurred. If the injury involves a fall, indicate any surfaces and / or objects the claimant fell on and where they fell from. Enter “NA” if no equipment, materials or chemicals were being used (e.g. Acetylene cutting torch, metal plate, etc.).

AVG WG/WK: Claimant’s average weekly wage, calculated by totaling the latest 52 weeks of wages (including overtime, tips, etc.) and dividing by 52.

CLAIMS ADMINISTRATOR: Enter the name of the carrier, third-party administrator, state fund, or self-insured responsible for administering the claim.

CONTACT NAME / TELEPHONE NUMBER: Enter the name of the individual at the employer’s premises to be contacted for additional information (i.e. Supervisor, HR Person, Nurse, etc.)

DATE DISABILITY BEGAN: The first day on which the claimant originally lost time from work due to the occupational injury or disease or as otherwised deigned by statute.

DEPARTMENT OR LOCATION WHERE ACCIDENT OR EXPOSURE OCCURRED: If the accident or exposure did not occur on the employer’s premises, enter address or location. Be specific (e.g. Maintenance, Client’s Office, Cafeteria, etc.).

EMPLOYEE STATUS: Indicate the employee’s work status from the following choices: Full-time, Part-time, Apprentice Full-time, Apprentice Part-time, Volunteer, Seasonal Worker, Piece Worker, On-Strike, Disabled, Retired, Not Employed or Unknown (you may also abbreviate the above as: (FT, PT, AFT, APT, VO, SW, PW, OS, DI, RE, NE, or UK).

HOW INJURY / ILLNESS OCCURRED: Describe the sequence of events leading to the injury or exposure (e.g. Worker stepped back to inspect work and slipped on some scrap metal. As worker fell, he brushed against the hot metal; Worker stepped to the edge of the scaffolding, lost balance and fell six feet to the concrete floor. The worker’s right wrist was broken in the fall).

NCCI CLASS CODE: A four-digit code classifying the occupation of the claimant.

OCCUPATION / JOB TITLE: Enter the primary occupation of the claimant at the time of the accident or exposure.

PART OF BODY AFFECTED: Indicate the part of body affected by the injury / illness (e.g. Right forearm, Low Back, etc.)

REPORT PURPOSE CODE: 00 = Original First Report of Injury; 02 = Updated or Amended First Report.

RTW DATE (Return to Work Date): Enter the date following the most recent disability period on which the employee returned to work.

SIC CODE: This is the code which represents the nature of the employer’s business which is contained in the Standard Industrial Classification Manual published by the Federal Office of Management and Budget.

SPECIFIC ACTIVITY EMPLOYEE ENGAGED IN DURING ACCIDENT / EXPOSURE: Describe the specific activity the employee was engaged in during the accident or exposure (e.g. Cutting metal plate for flooring, sanding ceiling woodwork in preparation for painting).

TYPE OF INJURY / ILLNESS: Briefly describe the nature of the injury or illness (e.g. Contusion, Laceration, Fracture, etc.)

WORK PROCESS THE EMPLOYEE WAS ENGAGED IN DURING ACCIDENT / EXPOSURE: Enter “NA” if employee was not engaged

in a work process, such as if walking down the hallway (e.g. Building maintenance).

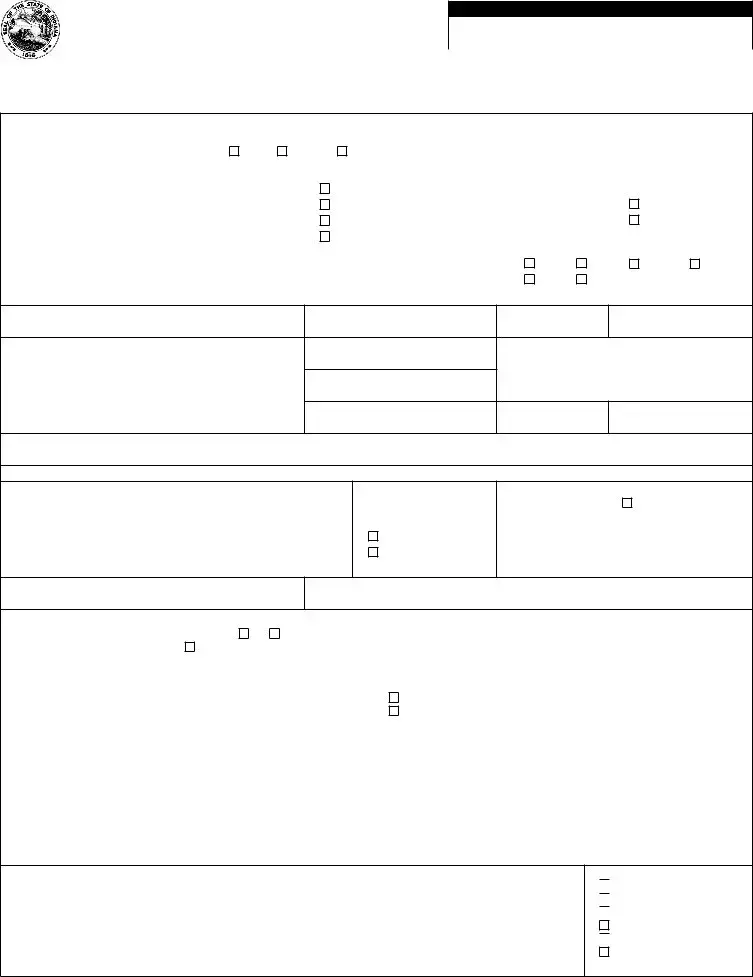

INDIANA WORKER’S COMPENSATION

FIRST REPORT OF EMPLOYEE INJURY, ILLNESS

State Form 34401 (R10 / 1-02)

FOR WORKER’S COMPENSATION BOARD USE ONLY

Jurisdiction |

Jurisdiction claim number |

Process date |

|

|

|

Please return completed form electronically by an approved EDI process. |

PLEASE TYPE or PRINT IN INK |

NOTE: Your Social Security number is being requested by this state agency in order to pursue its statutory responsibilities. Disclosure is voluntary and you will not be penalized for refusal.

EMPLOYEE INFORMATION

Social Security number |

Date of birth |

|

Sex |

|

|

|

Occupation / Job title |

|

|

|

NCCI class code |

|

|

|

|

Male |

Female |

Unknown |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name (last, first, middle) |

|

|

|

|

Marital status |

Date hired |

|

State of hire |

|

Employee status |

|

|

|

|

|

|

|

Unmarried |

|

|

|

|

|

|

|

|

Address (number and street, city, state, ZIP code) |

|

|

|

Married |

Hrs / Day |

Days / Wk |

|

Avg Wg / Wk |

|

|

Paid Day of Injury |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Separated |

|

|

|

|

|

|

Salary Continued |

|

|

|

|

|

|

Unknown |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Wage |

Per |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hour |

Day |

|

Month |

Telephone number (include area |

|

|

Number of dependents |

$ |

|

|

Week |

|

|

|

|

|

|

|

|

|

|

Year |

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EMPLOYER INFORMATION

Address of employer (number and street, city, state, ZIP code)

Employer’s location address (if different)

Carrier / Administrator claim number

Actual location of accident / exposure (if not on employer’s premises)

CARRIER / CLAIMS ADMINISTRATOR INFORMATION

Name of claims administrator |

Carrier federal ID number |

Check if appropriate |

|

|

|

Self Insurance |

Address of claims administrator (number and street, city, state, ZIP code) |

|

Policy / Self-insured number |

|

|

Insurance Carrier |

|

|

Telephone number |

Third Party Admin. |

Policy period |

|

|

|

From |

To |

OCCURRENCE / TREATMENT INFORMATION

Date of Inj./ Exp. |

Time of occurrence |

AM PM |

Date employer notified |

|

Type of injury / exposure |

|

Type code |

|

Cannot be determined |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Last work date |

Time workday began |

|

Date disability began |

|

Part of body |

|

Part code |

|

|

|

|

|

|

|

|

|

|

RTW date |

Date of death |

|

Injury / Exposure occurred |

Yes |

Name of contact |

Telephone number |

|

|

|

on employer’s premises? |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

Department or location where accident / exposure occurred |

|

|

|

|

All equipment, materials, or chemicals involved in accident |

|

|

|

|

|

|

|

|

Specific activity engaged in during accident / exposure |

|

|

|

|

Work process employee engaged in during accident / exposure |

|

|

|

|

|

|

How injury / exposure occurred. Describe the sequence of events and include any relevant objects or substances. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cause of injury code |

|

|

|

|

|

|

|

|

|

|

Name of physician / health care provider

Hospital or offsite treatment (name and address)

Name of witness |

|

Telephone number |

Date administrator notified |

|

|

|

|

|

|

Date prepared |

Name of preparer |

|

Title |

|

Telephone number |

|

|

|

|

|

|

INITIAL TREATMENT

No Medical Treatment

No Medical Treatment

Minor: By Employer

Minor: By Employer

Minor: Clinic / Hospital

Minor: Clinic / Hospital

Emergency Care

Hospitalized > 24 Hours

Hospitalized > 24 Hours

Future Major Medical / Lost

Time Anticipated

An employer’s failure to report an occupational injury or illness may result in a $50 fine (IC 22-3-4-13).

No Medical Treatment

No Medical Treatment

Minor: By Employer

Minor: By Employer

Minor: Clinic / Hospital

Minor: Clinic / Hospital

Hospitalized > 24 Hours

Hospitalized > 24 Hours