What is Form ST-105 and who uses it?

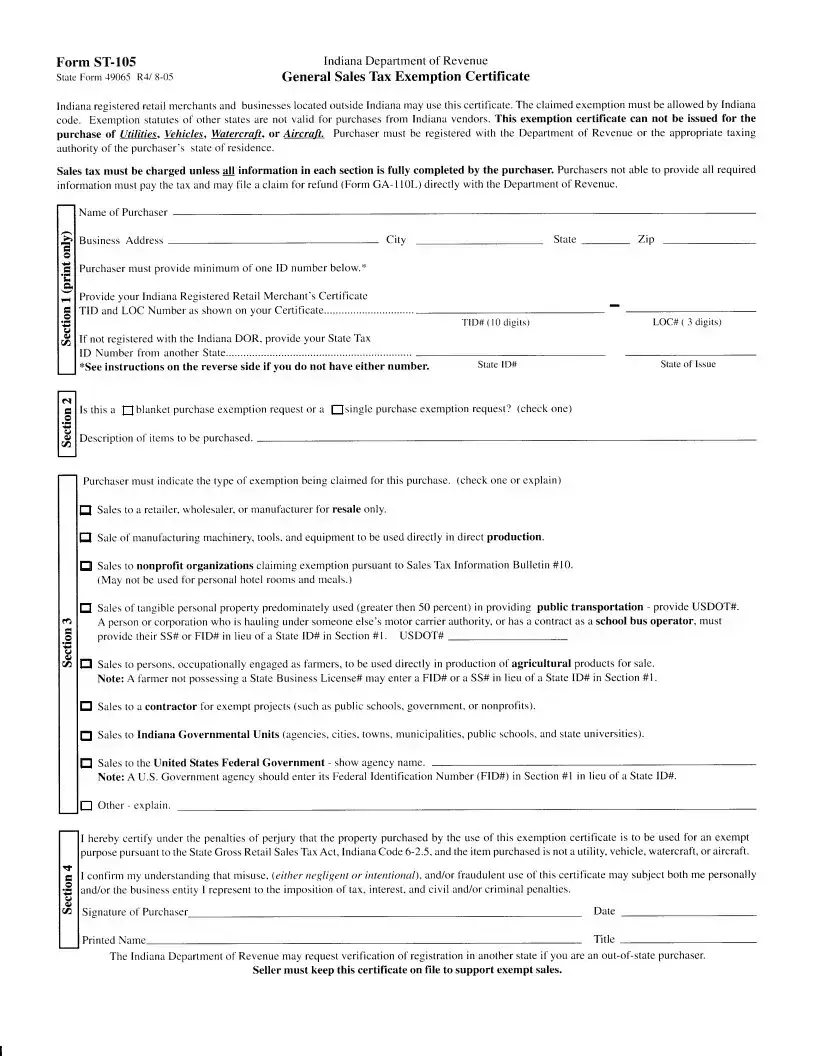

Form ST-105 is the General Sales Tax Exemption Certificate used in Indiana. It is utilized by Indiana registered retail merchants and businesses located outside of Indiana for purchasing items without paying sales tax. The form is necessary when the purchased items are for resale, manufacture, non-profit activities, or other qualified exemptions as defined by Indiana code. The claimed exemption must align with Indiana's statutes, as exemptions from other states are not valid for purchases from Indiana vendors.

Can Form ST-105 be used for purchasing anything tax-exempt?

No, there are specific restrictions on the use of Form ST-105. It cannot be issued for the purchase of utilities, vehicles, watercraft, or aircraft. The form is primarily designed for items that will be resold, used in manufacturing, provided to non-profit organizations, or used in qualifying exempt activities as outlined by the state. Users must ensure their purchases align with the exemptions allowed under Indiana code.

What information must be provided on Form ST-105?

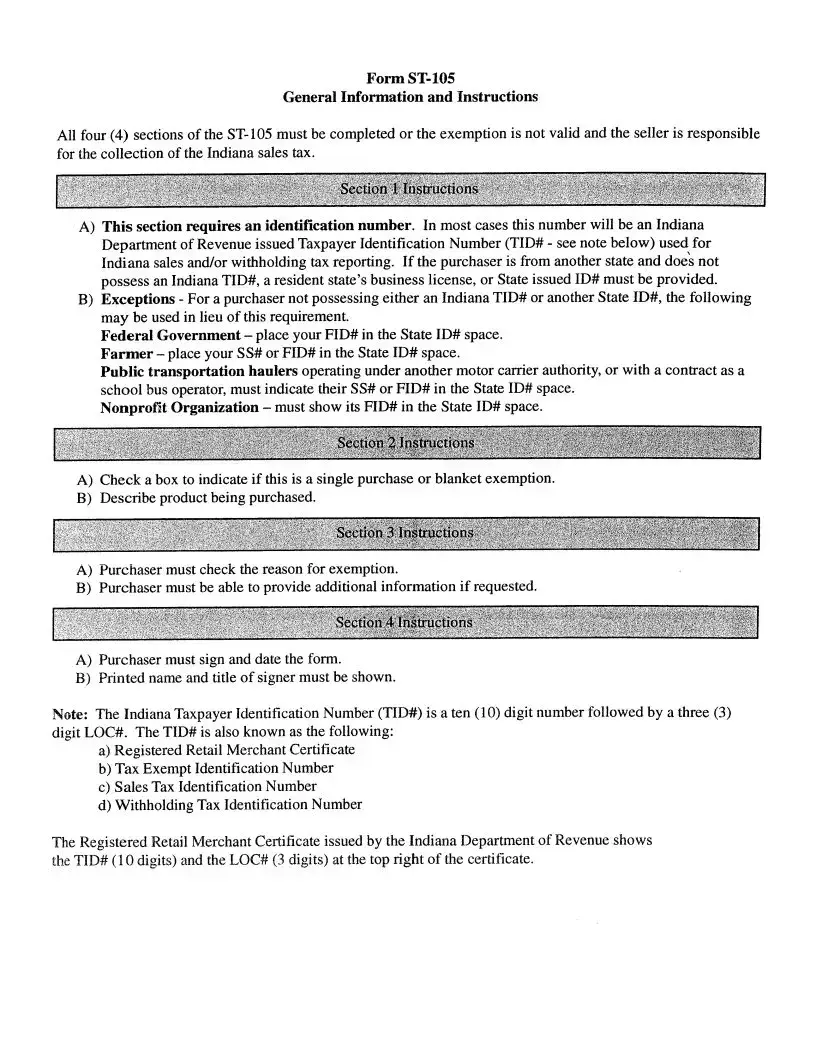

To complete Form ST-105, purchasers must provide their business name, address, and at least one identification number—either the Indiana Registered Retail Merchant's Certificate TID and LOC Number or a State Tax ID Number from another state. Also, the form requires the purchaser to indicate whether the exemption is for a single purchase or a blanket exemption, describe the items to be purchased, and specify the type of exemption claimed. All sections of the form must be completed for the exemption to be valid, including the signature of the purchaser and the date.

What if a purchaser does not have any ID number required on Form ST-105?

If a purchaser does not possess an Indiana Department of Revenue issued Taxpayer Identification Number (TID#) or a State ID# from another state, there are specific exceptions allowed. Federal Government entities can use their Federal Identification Number (FID#), farmers can enter an FID# or SS#, public transportation haulers or contracted school bus operators can indicate their SS# or FID#, and non-profit organizations must show their FID#. These exceptions enable entities without a traditional State ID# to claim exemption when applicable.

Is a purchaser always exempt from sales tax if they submit a completed Form ST-105?

Not necessarily. The completion and submission of Form ST-105 indicate the purchaser's intent to buy goods tax-exempt for reasons authorized by Indiana law. However, the purchaser's eligibility and the nature of the goods or services bought must strictly comply with Indiana's exemption statutes. If a purchase does not meet these criteria, the exemption is not valid, and sales tax should be paid. Fraudulent use of this certificate can lead to penalties, including tax liabilities, interest, and possibly criminal charges.

How long should the seller keep Form ST-105 on file?

Sellers are required to keep completed Form ST-105 certificates on file to support exempt sales. While the document does not specify a retention period, it is generally recommended for businesses to retain sales tax exemption certificates and related records for at least seven years to comply with tax audit requirements and to verify the legitimacy of tax-exempt transactions.

Can anyone claim exemption by simply filling out Form ST-105?

No, only eligible businesses or organizations that meet specific criteria set by Indiana can claim an exemption using Form ST-105. The form serves as an affidavit where the purchaser certifies that the items bought are for qualifying exempt purposes. Claiming a fraudulent exemption knowingly can result in significant consequences, including repayment of tax, additional interest, penalties, and legal action. Therefore, it is imperative to understand and comply with the exemption qualifications as described by Indiana law.