|

Form |

|

Indiana Department of Revenue |

|

|

ST-103DR |

Recap of Prepaid Sales Tax by Distributors |

|

State Form 51068 |

|

|

|

|

|

|

|

|

(R4 / 9-12) |

IMPORTANT: This form must be fi led even when no transactions have occured. |

|

|

|

|

|

|

1. Taxpayer Identifi cation Number |

|

2. For Tax Period (month/year) |

|

3. Federal Identification Number |

|

|

|

|

/ |

|

|

|

|

|

|

|

|

|

|

|

4. |

Taxpayer Name |

|

|

5. Doing Business as Name (DBA) |

|

6. Telephone Number |

|

|

|

|

|

|

7. |

Street Address, City, State Zip Code |

|

|

8. Gasoline Distributor Status (Check One) |

|

|

|

|

|

Qualifi ed Distributor □ |

|

|

|

|

|

Non-Qualifi ed Distributor □ |

9. |

Which sales tax return are you filing (Check One) |

ST-103 □ ST-103MP □ None □ |

|

|

|

|

NOTE: THIS FORM MUST BE PRINTED OR TYPED |

|

|

|

|

|

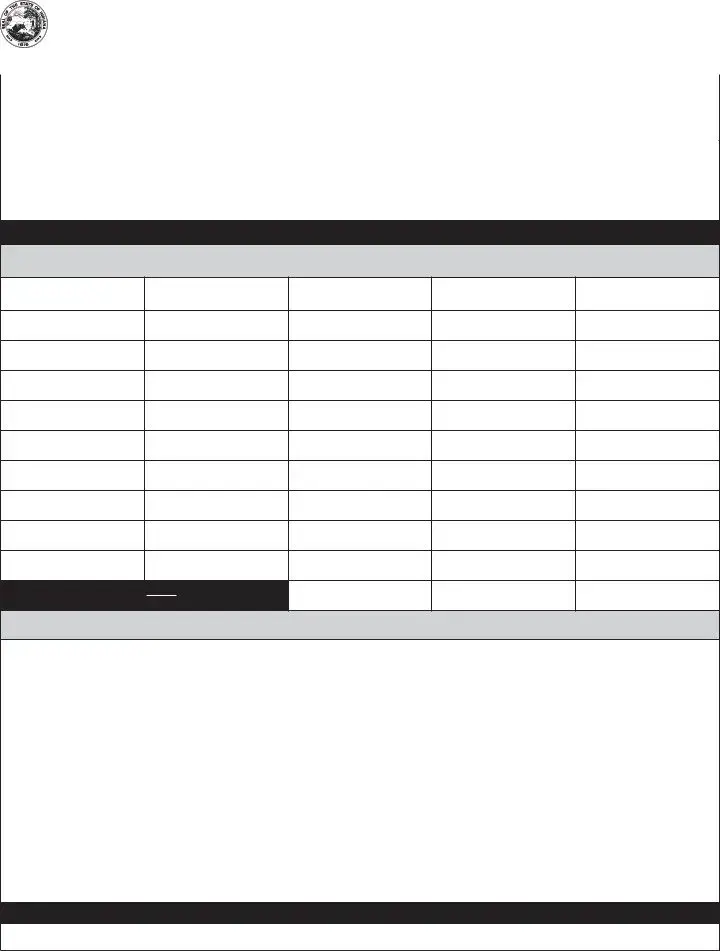

Section I: |

|

From Whom Did You Buy Fuel? |

|

12.Supplier Federal ID Number

13.Total Gallons Purchased

14.Prepaid Sales Tax Paid to Supplier

Note: You Must Complete BOTH Sides of this Form

Instructions for Section I

1.Provide your Indiana Taxpayer Identifi cation Number (TID).

2.What Tax Period (month/year) Note: This report is due the last day of the month following the reporting period.

3.Enter your Federal Identifi cation Number (FID).

4.Provide the Taxpayer’s legal name.

5.List the Doing Business as Name for your company.

6.Please list your company’s telephone number including area code.

7.Provide your business address.

8.Check your Distributor Status.

9.Check which tax return you are filing.

10.List the names of the companies you purchase from.

11.List the address of the companies you purchase from.

12.List your supplier’s Federal Identification Number.

13.List total gallons purchased from each supplier.

14.Provide the amount of prepaid sales tax you paid each supplier.

15.Total the number of gallons purchased and the amount of prepaid sales tax paid for the reporting month.

This report must be fi led MONTHLY. It is due on the last day of the month following the reporting period.

□Please check this box if your business has permanently closed and provide the closed date. ____/____/____

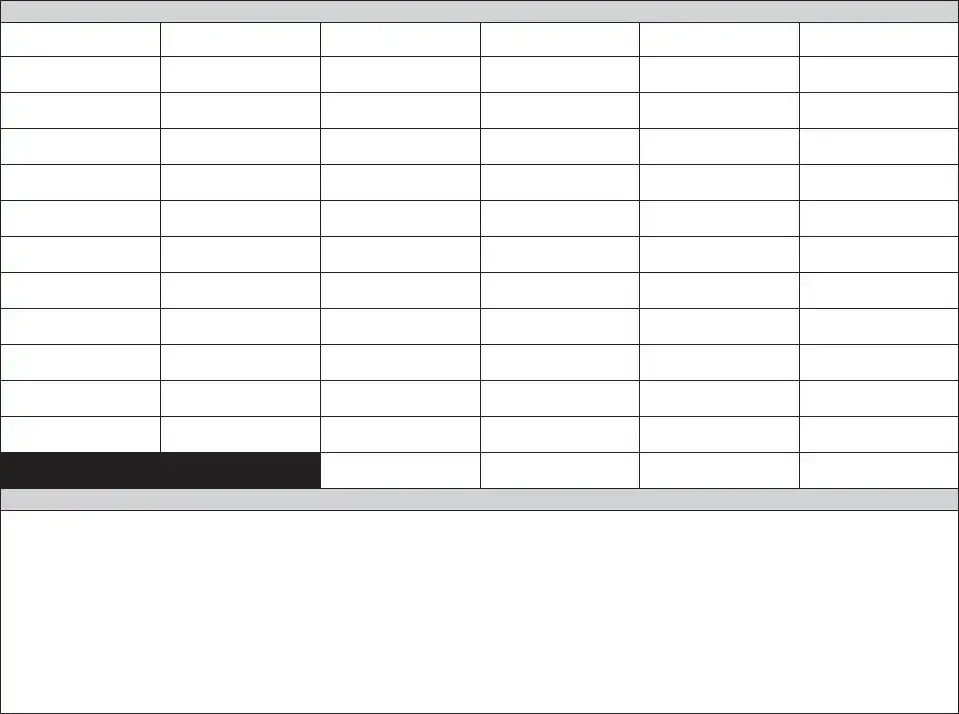

SECTION II |

To Whom Did You Sell Fuel? |

18.Customer’s Federal ID Number

21. Prepaid RST Collected

All Gallons EXEMPTED and TAXED must be shown

Instructions for Section II

16.List your Customer’s Name. (Attach additional sheets if necessary).

17.List your Customer’s Address.

18.List your Customer’s Federal ID Number.

19.List the total gallons of gasoline sold for this month to each customer.

20.List the total tax exempt gallons sold to each customer.

21.List the total amount of Prepaid Sales Tax collected for this month from each customer.

22.Total the amounts of all columns and give the total gallonage and amount collected here.

I declare, under penalties of perjury that this is a true, correct and complete report.

Mail to: Indiana Department of Revenue Excise Tax

P.O. Box 6114 Indianapolis, IN 46206-6114 (317) 615-2552

______________________________________________ |

_____________________________________________ |

__________________________ |

________________ |

Printed Name |

Authorized Signature |

Title |

Date |