What is the Indiana SR21 form?

The Indiana SR21 form, known formally as the Indiana Operator’s Proof of Insurance/Crash Report, is a document that verifies a driver's insurance coverage at the time of a motor vehicle collision. This form is also used to report specific details about the crash, such as the date, time, location, and parties involved. It serves both as proof of insurance and as an official crash report to the Bureau of Motor Vehicles (BMV).

When is the Indiana SR21 form required?

This form is required for any motor vehicle collision resulting in injury, death, or property damage amounting to $1000 or more. It must be submitted to the Bureau of Motor Vehicles within 10 days from the date of the accident. The form is crucial for the administration of the Safety Responsibility Law and helps in collecting data for crash prevention efforts.

Who is responsible for completing the SR21 form?

The driver involved in the collision is responsible for filling out the SR21 form. If the driver is physically unable to complete the form due to injuries, any passenger in the vehicle at the time of the crash, or a witness to the accident, may fill out the report instead. The completion and submission of this form are essential to comply with state laws.

What happens if I don't submit the SR21 form?

Failure or refusal to submit the SR21 form within the ten-day window is cause for the suspension or revocation of the driver's license and vehicle registration. Additionally, not reporting the crash as required by law is considered a misdemeanor. It's important to submit this form promptly to avoid legal consequences.

How can I obtain an SR21 form?

You can obtain an SR21 form from several sources, including the nearest police authority, the Bureau of Motor Vehicles, or online through the official BMV website. It is important to ensure that the form is filled out completely and accurately to avoid the need for submitting a supplementary report.

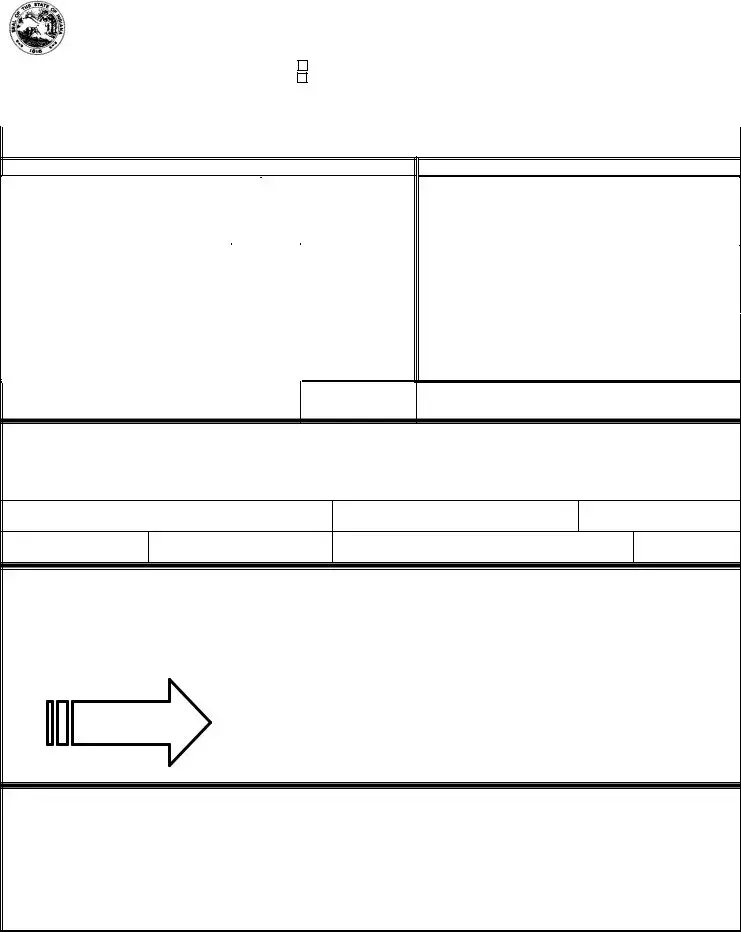

What information do I need to provide on the SR21 form?

The form requires detailed information about the collision, including the date, time, and location of the accident, details of all vehicles and drivers involved, and a verification of insurance coverage at the time of the crash. All information must be written in capital letters, except the signature, and any unknown answers should be marked as "U" for unknown.

Who verifies my insurance on the SR21 form?

An insurance agent or an authorized representative from your insurance company must sign the SR21 form to verify that you had valid insurance coverage at the time of the accident. If this section is left unsigned, it implies that the driver did not have insurance coverage during the collision.

Where should the completed SR21 form be sent?

The completed form should be sent to the Bureau of Motor Vehicles, specifically to the PFR/Crash Report Section at P.O. Box 7169, Indianapolis, IN 46207. Do not send the form to the county where the crash occurred. Proper submission ensures that the report is processed correctly and in accordance with Indiana laws.

Is the information on the SR21 form confidential?

Yes, by law, the information provided on the SR21 form is confidential and cannot be used as evidence in any trial. The primary purpose of the form is for the administrative use of the Safety Responsibility Law and to gather data that can contribute to crash prevention strategies.