What is the OTP 901 form used for in Indiana?

The OTP 901 form is used to apply for a license as an Other Tobacco Products Distributor in Indiana. This license is necessary for businesses that plan to distribute tobacco products other than cigarettes, such as cigars, snuff, chewing tobacco, and any other non-cigarette tobacco products. The form is required for both new licenses and renewal of existing licenses.

When must the OTP 901 form be submitted to the Indiana Department of Revenue?

The form must be submitted 30 days prior to either the expiration of the current license or the date the business plans to begin operations. It is important to adhere to this timeline to ensure there is no interruption in the ability to legally distribute tobacco products.

Can a business legally distribute tobacco products without a certificate?

No, a business cannot legally distribute other tobacco products without first obtaining the required certificate from the Indiana Department of Revenue. The OTP 901 form serves as the application for this certificate. Operating without it is against the law.

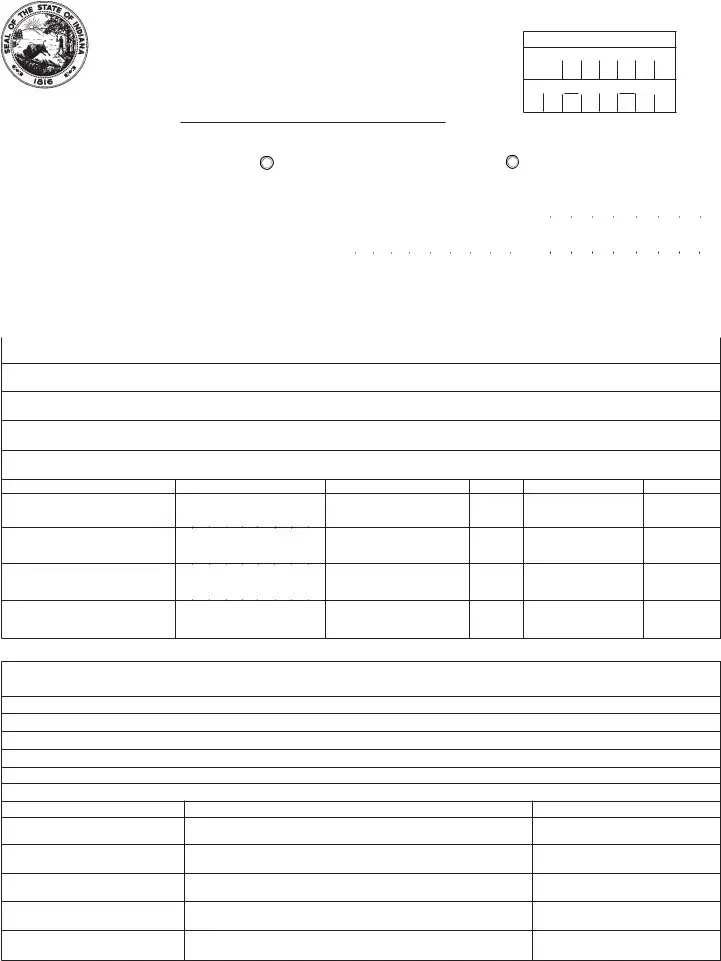

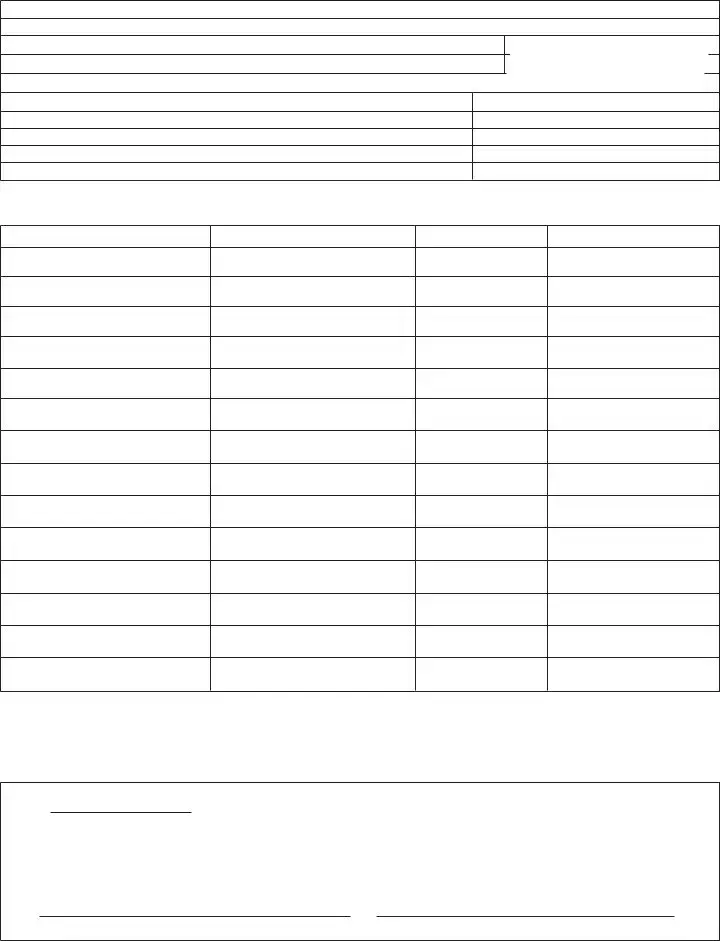

What information is required on the OTP 901 form?

The form requires detailed information, including the applicant's name, which can be an individual, partnership, or corporation, Federal ID Number, business/trade name if different, owner's Social Security Number, and contact information. Additionally, the type of ownership, details of incorporation for corporations, identification of partners or corporate officers, reasons for needing the license, other held licenses, audit information, and data concerning the supply and distribution of tobacco products must be provided.

Are there specific details needed about the distribution of tobacco products?

Yes, applicants need to provide specific details including the names, addresses, phone numbers, and estimated annual purchases from suppliers of other tobacco products. If the list is extensive, a computer-generated list that includes all requested information is accepted. Furthermore, if the company expects to sell products into another state, those states need to be listed on the form.

What happens if the OTP 901 form is not submitted on time?

If the form is not submitted on time, the business may face a disruption in its operation. Late submission can result in the expiration of the existing license without a renewed certificate in place, making it illegal to distribute other tobacco products until the new license is approved and issued.

How is the completed OTP 901 form submitted?

Upon completion, the OTP 901 form should be sent to the Indiana Department of Revenue, specifically to the address provided on the form itself: P.O. Box 901, Indianapolis, IN 46206-0901. It is important to ensure the form is fully completed and signed, declaring under penalties of perjury that the information provided is true, correct, and complete.