What is the purpose of the Indiana Financial Declaration Form?

The Indiana Financial Declaration Form serves as a comprehensive financial disclosure statement in family law cases, particularly in matters of marriage dissolution. It is designed to present a detailed account of the financial status of either party involved in the case. This includes income, expenses, assets, and liabilities. Providing accurate and complete information is crucial for the court to make informed decisions regarding child support, alimony, and the division of property.

Who needs to fill out the Financial Declaration Form?

Either the petitioner or the respondent in a family law case, such as a divorce or custody matter, is required to fill out the Financial Declaration Form. It's essential for both parties involved in the legal proceeding to provide their financial details accurately to ensure a fair assessment is made regarding financial obligations and entitlements.

What information do I need to provide in the form?

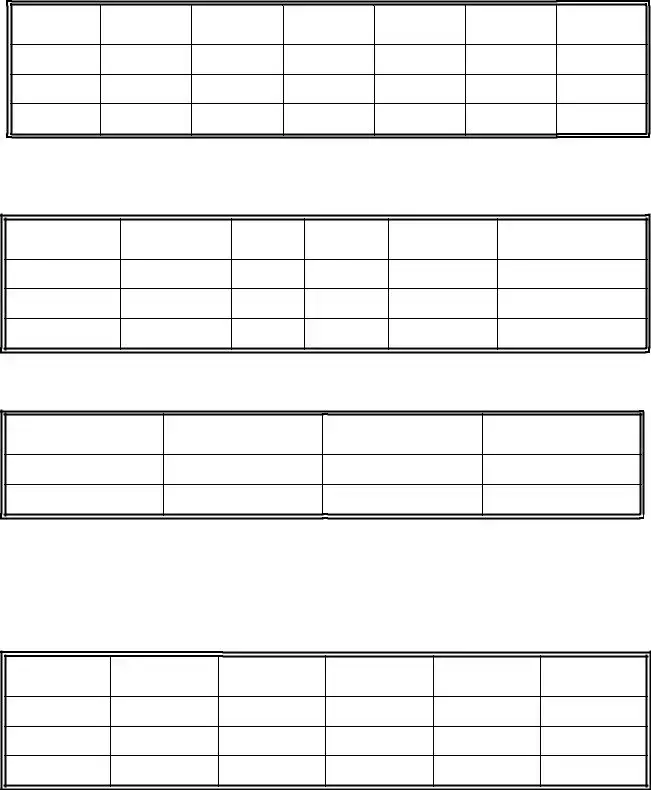

The form requires a range of detailed information, including preliminary personal information, employment and income details, health insurance information, monthly living expenses, and any deductions or child support obligations. Specifics such as names, social security numbers, addresses, employment history, gross and net income, weekly deductions, and detailed monthly expenses for various categories are needed.

How do I calculate my weekly income if I am paid monthly?

To convert your monthly income to a weekly amount, you should divide the total monthly income by 4.3. This formula accounts for the fact that some months are longer than others, providing a more accurate reflection of your average weekly earnings.

What if I have expenses not explicitly listed on the form?

For expenses not specifically mentioned in the form's categories, you can list them under the "Other" sections provided in each relevant part of the form. It's important to include all significant expenses to ensure the court has a comprehensive understanding of your financial situation.

Is it mandatory to attach additional documents with the form?

Yes, in all cases involving child support, you are required to prepare and attach an Indiana Child Support Guideline Worksheet along with your Financial Declaration Form. If you cannot provide this at the time of submission, you must supplement the form with the worksheet within ten days of the exchange of this form. Documentation verifying your income should also accompany the worksheet.

What happens after I submit the Financial Declaration Form?

After submission, the court will review the information provided in your Financial Declaration Form along with any accompanying documents. This review helps the court make informed decisions on financial matters in your case such as asset division, child support, and alimony. You might also be asked to provide additional information or clarification if necessary.