What is the Indiana 43709 form?

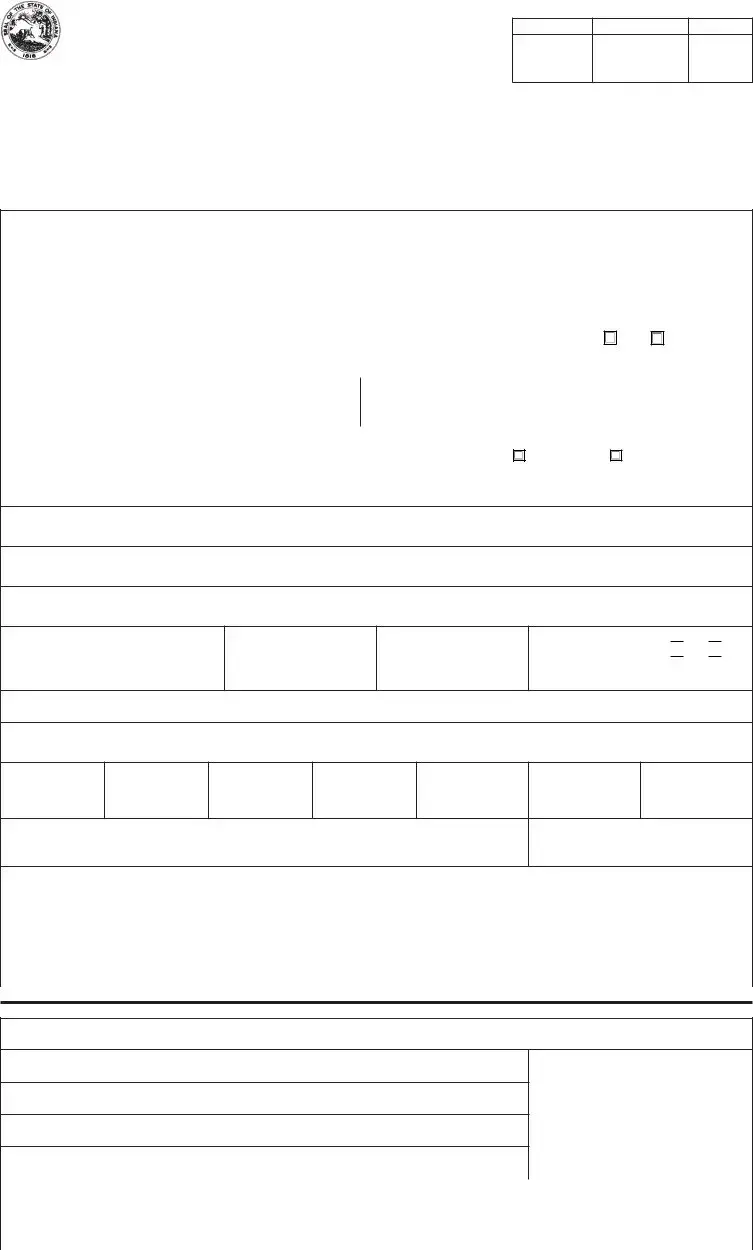

The Indiana 43709 form is an official document used to apply for a deduction from assessed valuation based on mortgage or contract indebtedness. It is essential for property owners in Indiana who aim to reduce their taxable assessed property value, thereby lowering their property taxes. This deduction applies to both real property and mobile homes, as assessed under specific Indiana Code (IC) sections.

Who can file the Indiana 43709 form?

The form can be filed by the owner of the property or the contract buyer. Applicants must be residents of Indiana. It's important to note that restrictions apply if the property is co-owned or if the applicant is not the sole legal or equitable owner. Specific details about the owner's share of interest or co-ownership with someone other than a spouse should be provided when filing the form.

When should the Indiana 43709 form be filed?

For real property, the form must be filed during the 12 months before May 11 of the year for which the deduction is to be effective. For mobile homes that are assessed under IC 6-1.1-7, the form should be filed between January 15 and March 2 of the effective year of the deduction.

How can the Indiana 43709 form be filed?

Applicants have the option to file this form in person or by mail with the County Auditor of the county where the property is located. If choosing to mail the form, ensure the mailing is postmarked before the last day for filing to meet the deadline requirements.

What happens if someone falsely files the Indiana 43709 form?

Filing false information on the Indiana 43709 form is considered perjury, a serious crime. Individuals convicted of perjury for falsely applying for this deduction face penalties as provided by law. Accuracy and truthfulness in completing this form are paramount.

How is the deduction amount determined?

The deduction amount is the lesser of $3,000, one-half of the assessed value of the property, or the balance of the mortgage or contract indebtedness as of the assessment date. This calculation ensures that the deduction accurately reflects the mortgage or contract indebtedness without exceeding set limits.

Is it necessary to file the Indiana 43709 form every year?

Once the application is filed and in effect, no further action is necessary unless there is a change in the status of the property or the applicant that would affect the deduction. This includes changes in ownership, the mortgage or contract indebtedness amount, or the applicant’s residency status.

Can someone else sign the Indiana 43709 form on behalf of the applicant?

Yes, the authority to sign the deduction application can be delegated. However, this is only permissible if done through an executed power of attorney or in accordance with IC 6-1.1-12-.07. In instances where the property is owned by a husband and wife as tenants by the entireties, the signature of only one spouse is required.

What specific information is required when filing this form?

Applicants must provide detailed information including the full name of the mortgagee or contract seller, the address, and the exact amount of mortgage or contract indebtedness unpaid as of March 1 of the current year. Additionally, a legal description of the property, and details regarding any co-ownership or different names on the property record versus the applicant's name, are required.

What are the provisions for military service members concerning this form?

Indiana residents who are members of the United States Armed Forces and were away from their county of residence due to military service during the filing period are granted an extension. They must file their claim for the deduction during the twelve months before May 11 of the year following their year of discharge from service.

Yes

Yes

No

No